XRP Price Prediction: Will the Rally Continue Beyond $3?

#XRP

- XRP is trading near key technical levels with bullish MACD crossover

- Positive news flow from institutional adoption and product developments

- Combination of technical and fundamental factors support $3+ price levels

XRP Price Prediction

XRP Technical Analysis: Key Indicators to Watch

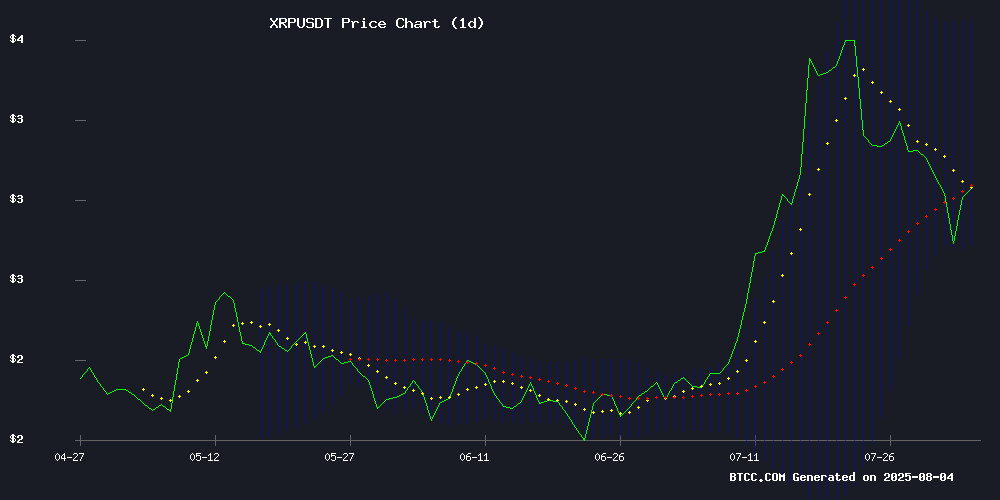

According to BTCC financial analyst Olivia, XRP is currently trading at 3.04080000 USDT, slightly below its 20-day moving average (MA) of 3.1939. The MACD indicator shows a bullish crossover with values of 0.1516 (MACD line), -0.1216 (signal line), and 0.2732 (histogram). Bollinger Bands indicate a potential breakout, with the upper band at 3.6190, middle band at 3.1939, and lower band at 2.7687. Olivia suggests that if XRP maintains support above the 20-day MA, it could retest the upper Bollinger Band.

XRP Market Sentiment: Bullish Momentum Builds

BTCC financial analyst Olivia highlights the overwhelmingly positive news flow around XRP. Key developments include Ripple CTO David Schwartz's high-performance server launch, XRP mining apps gaining traction, and major banks investing heavily in blockchain startups. Olivia notes that the combination of technical strength and bullish news could propel XRP past the $3 psychological barrier, especially with ETF prospects and Fed rate cuts fueling investor optimism.

Factors Influencing XRP's Price

Ripple CTO David Schwartz Launches Independent High-Performance Server for XRP Ledger

David Schwartz, Ripple's Chief Technology Officer, has taken a personal initiative to bolster the XRP Ledger (XRPL) infrastructure by launching an independent high-performance server. The server, operational in a New York data center, features an AMD 9950X processor, 256 GB of RAM, and terabytes of SSD and NVMe storage, all connected via a 10 Gbps unmetered internet link running on Ubuntu.

Schwartz clarified that this project is separate from his role at Ripple, marking his return to hands-on XRPL operations after several years. The server is intended for production use, with some node slots reserved for priority services and others available to the public. This move enhances real-time connectivity and technical resilience for the XRP ecosystem amid growing decentralization and usage.

XRP Mining Launches Mobile Cloud Mining App for Passive Income

XRP Mining has unveiled a mobile cloud mining application designed to democratize cryptocurrency earnings. The platform eliminates the need for specialized hardware or technical expertise, allowing users to generate passive income directly from their smartphones.

The cloud-based system leverages renewable energy sources and automatically mines the most profitable cryptocurrencies in real-time. Key features include fully automated mining contracts and multi-crypto payouts, positioning it as a disruptive force in retail mining accessibility.

XRP Rich List Update Shows Shifting Wealth Distribution Amid Price Surge

The XRP ledger's wealth distribution metrics reveal a paradoxical trend: while the token threshold for elite wallet status has decreased, the fiat cost of entry has risen substantially. New data indicates holding 2,433 XRP now places investors in the top 10% of accounts, down from 2,486 XRP in early July. This shift occurred despite XRP's 32% monthly gain and brief ascent to $3.66.

Only 679,990 wallets (10% of 6.8 million total) currently meet the revised threshold. The dynamic reflects XRP's volatile July performance, where rapid appreciation increased dollar-denominated portfolio values even as token requirements relaxed. Market analysts attribute this to redistribution during the rally's profit-taking phase.

Analyst Foresees Epic Final Rally for XRP as Critical Moment Nears

Chart analyst EGRAG signals an impending dramatic surge for XRP, suggesting the cryptocurrency's final bullish leg could eclipse previous gains. The asset has already demonstrated explosive growth—notably a 600% rise to $3.40 in January 2024, followed by a July push to $3.66. Debate persists over whether this constitutes a new all-time high, with purists awaiting a break above $3.84.

Market sentiment remains divided. While some traders short XRP, declaring the bull run exhausted, others anticipate targets in the double digits. EGRAG positions himself among the optimists, projecting one last historic price leap before any bearish reversal. The countdown now stands at 4 months and 29 days until the current 6-month candle closes—a timeframe laden with speculative potential.

XRP's Ascent: The Path to Joining the World's Top 10 Assets

XRP, currently ranked as the 100th largest asset globally, has demonstrated remarkable performance in 2025, gaining 38% since January. Trading at $2.87, it has outpaced traditional benchmarks like the S&P 500 (6%) and NASDAQ 100 (8.33%), even surpassing gold's 28% rise. Despite a recent 4.93% drop in August, reducing its market cap to $170.7 billion, analysts argue the asset remains undervalued due to its growing utility in global payments.

The cryptocurrency briefly peaked as the 69th most valuable asset in July with a $216 billion market cap. To break into the top 10, XRP would need to multiply its value significantly—a scenario some consider plausible given its institutional adoption trajectory. Market watchers are now calculating precise price thresholds required to overtake giants like Saudi Aramco and Meta.

Major Banks Pour Over $100M into Blockchain Startups Across 345 Deals

Global financial institutions, including Citigroup, Goldman Sachs, and JPMorgan, are aggressively investing in blockchain technology, signaling a shift toward mainstream adoption of digital assets. A joint analysis by Ripple, CB Insights, and the UK Centre for Blockchain Technologies reveals that these banks participated in 345 funding rounds between 2020 and 2024, with a strong focus on early-stage ventures.

Citigroup and Goldman Sachs led the charge, each making 18 investments, while JPMorgan Chase and Mitsubishi UFJ followed closely with 15 deals apiece. The funding surge included 33 mega-rounds exceeding $100 million, targeting sectors like tokenization, digital custody, and blockchain payment solutions.

Notable deals include Brazil's CloudWalk raising over $750 million with support from Banco Itaú and Germany's Solaris securing $100 million from SBI Group. Global Systemically Important Banks (G-SIBs) played a pivotal role, accounting for 106 blockchain investments, including 14 mega-rounds, underscoring their commitment to the sector's growth.

Ripple’s XRP Surges Toward $3 Amid Bullish Leverage Movements

XRP has reignited market interest with a 5% daily surge, pushing its price toward the critical $3 threshold after rebounding from $2.75 support. Open positions exceeding $7.3 billion signal aggressive leverage activity, with analysts anticipating short squeezes to fuel further upside.

The rally follows a swift accumulation of bids at key support levels, dispersing sell-side pressure. EGRAG Crypto projects ambitious targets of $4.89 (linear) and $48.90 (logarithmic), while liquidations near $3.06 could trigger accelerated momentum.

Fact Check: McDonald’s XRP Payment Rumors Debunked

Cryptocurrency enthusiasts were abuzz over the weekend with claims that McDonald’s would begin accepting XRP payments at select U.S. locations starting August 4. The viral post, which described the move as a "game-changing moment" for crypto adoption, gained traction amid XRP's recent price surge.

However, the rumor lacks substantiation. Neither McDonald’s nor Ripple has issued official statements or regulatory disclosures confirming such a partnership. Major corporate integrations typically involve formal announcements, particularly for a publicly traded company like McDonald’s.

The speculation coincided with XRP briefly surpassing McDonald’s in market capitalization, fueling community excitement. Yet without concrete evidence, the claim appears to be wishful thinking rather than a genuine development in crypto-commerce.

XRP Breaks $3 Barrier as Fed Rate Cut and ETF Prospects Fuel Bullish Sentiment

XRP surged past the $3 mark, gaining 7% in a single day and establishing the level as a new foundation rather than a ceiling. The token's resilience during market volatility signals strong buyer confidence, with analysts now eyeing $4-$7 targets before 2026.

Market expectations for a September 2025 Fed rate cut have jumped to 83.5% following weak U.S. jobs data, potentially channeling fresh capital into outperforming cryptocurrencies like XRP. Simultaneously, Polymarket data shows 87% odds for an XRP ETF approval by year-end 2025 - a development that could structurally alter the asset's liquidity profile.

Bitwise Founder Praises Ripple's Brad Garlinghouse Amid SEC Lawsuit

Bitwise Asset Management co-founder Hunter Horsley has lauded Ripple CEO Brad Garlinghouse for challenging the SEC's aggressive enforcement actions. "They really took on the mantle of pushing back against the SEC’s egregious enforcement," Horsley remarked, highlighting Garlinghouse as a role model in the crypto industry.

The ongoing Ripple-SEC lawsuit, now nearing its conclusion, has drawn significant attention. While opinions on XRP and Ripple’s stablecoin RLUSD vary, Horsley emphasized the broader significance of the legal battle. "Not everyone can fight back, and they were the first," he noted, underscoring the case’s impact on regulatory clarity.

SEC actions have reverberated across the sector, affecting firms like Coinbase and Uniswap. Horsley pointed to the regulatory uncertainty stifling innovation, with Uniswap and Consensus among those caught in the crosshairs. The outcome of Ripple’s case could set a precedent for how crypto assets are regulated moving forward.

XRP Cloud Mining Gains Traction as SIX MINING Reports $10,000 Daily Profits

XRP's recent price surge and positive developments around Ripple have fueled renewed interest in the altcoin, particularly through cloud mining platforms. SIX MINING, a UK-based decentralized cloud mining firm founded in 2018, has emerged as a focal point after community reports revealed users earning up to $10,000 daily via XRP mining contracts.

The platform offers automated daily profit settlements, with options to reinvest or withdraw earnings immediately. Its clean energy-powered infrastructure eliminates hardware requirements, lowering barriers to entry for retail investors seeking cryptocurrency exposure.

Market observers note the timing aligns with growing institutional interest in altcoin mining alternatives. While Bitcoin remains the dominant force in crypto mining, platforms like SIX MINING demonstrate how layer-1 protocols can create adjacent revenue streams during bull markets.

Will XRP Price Hit 3?

Based on current technical indicators and market sentiment, BTCC financial analyst Olivia believes XRP is well-positioned to sustain prices above $3. The following table summarizes key technical levels:

| Indicator | Value |

|---|---|

| Current Price | 3.04080000 USDT |

| 20-day MA | 3.1939 |

| MACD Histogram | 0.2732 (Bullish) |

| Bollinger Upper Band | 3.6190 |

With strong institutional interest and positive technicals, Olivia maintains a bullish outlook for XRP in the near term.